Our partners have over 200 years of combined secondary and private equity experience with an extensive track record including:

Represents partner experience at Fairview and other firms.

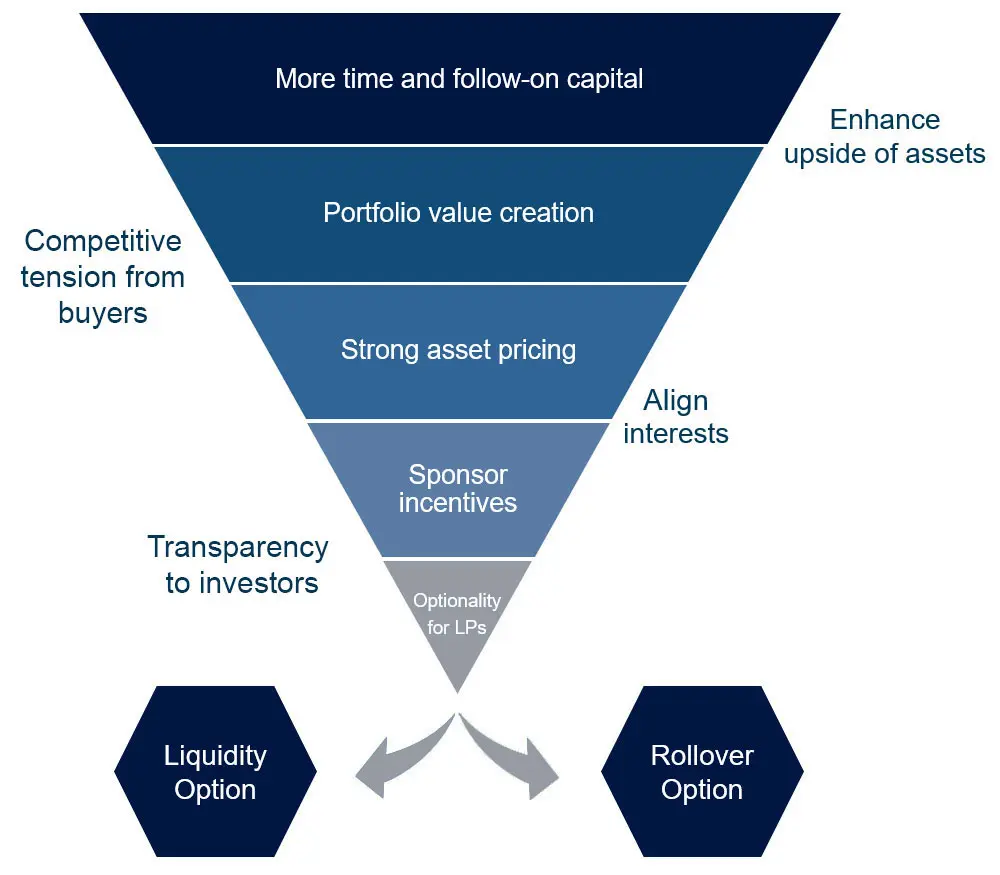

We provide optionality for limited partners as a driver of solutions.

Clarity of process, deal roadmap and drivers of portfolio value

Symmetry of information between prospective buyers and limited partners

Management of investor communications and deal walk-through

Regular consultation with advisory board

Provide unencumbered advice to:

- Private equity sponsors

- Advisory boards

- Limited partners

- Senior attention and commitment to every transaction

- Team has worked together for over 10 years

- Leverage 200 years of private equity experience as limited partners, investor relations and general partners

- Manage and mitigate conflicts of interest

- Provide transparency to processes

- Follow a standardized roadmap

- Closed $18bn of deal volume across 70 secondary transactions(1)

- Successful waiver of conflicts in all transactions

- Over 800 Limited Partners participated in liquidity solutions

(1)Represents individual partner experience

Pablo Caló

Managing Partner | London

pablo.calo@fairviewcapitalgroup.com

Pablo has spent the last 28 years dedicated to private equity in developed and emerging markets.

He was the Head of International Secondaries at Blackstone under Park Hill where he led close to $12bn in deal volume.

Prior to Blackstone, Pablo was the Head of Europe and co-managed the secondary investment strategy for PineBridge Investments, a global asset manager. In his role, he sat on Advisory Boards and had oversight for a portfolio of over 500 buyout and venture capital funds.

Besides transactional experience, Pablo brings perspective from a limited partner's viewpoint. When addressing conflicts of interest, Pablo takes the perspective of what is acceptable to all participants and runs a wide range of alternative scenarios with the sponsor prior to presenting options to investors. He also provides insight on buyer demand, pricing expectations, and structuring options in order to serve all constituents. Pablo holds a BS in Agricultural Engineering from UDELAR and an MBA from Yale University.

John Leone

Managing Partner | New York

john.leone@fairviewcapitalgroup.com

John has over 25 years of diverse private equity experience covering developed and emerging markets, and working on complex limited partner matters and private equity investments.

As a managing partner of ForeVest Capital Partners, a private equity fund manager, John led several GP-led solutions for private equity funds from the perspective of the general partner. In this capacity, he was responsible for developing strategy for successful execution of the restructurings and leading communications with the limited partners. He, therefore, brings valuable experience and perspective as an advisor.

Prior to founding ForeVest Capital Partners, John was a managing director at PineBridge Investments and AIG Capital Partners. He also formerly served as the General Counsel of PineBridge’s Emerging Markets (ex-Asia) Private Equity operations.

John earned a Juris Doctor, with high honors, from The George Washington University Law School, where he was a member of the Law Review and a Bachelor of Arts, magna cum laude, from the State University of New York at Binghamton.

George Slade

Partner | London

george.slade@fairviewcapitalgroup.com

George has over a decade of experience dedicated to secondaries and has advised on over $13bn of deal volume.

He has focused on GP-led solutions including multi-asset continuation funds, single asset continuation funds, fund tenders, fund expansions, and strip sales.

George has also worked with some of the largest U.S. and European pension plans on LP-led solutions and advised on one of the largest post-crisis collateralised fund obligations, which resulted in the first listed bond in Singapore backed by private equity cash flows.

Prior to joining Fairview, George worked in the secondary advisory team of Blackstone and PJT Partners. At Blackstone, he assisted Larry Thuet and Pablo Calo in setting up the European office of the secondary advisory team.

Before working at Blackstone, George was an investment professional at PineBridge Investments in their secondaries team.

Prior to PineBridge, George was at the Bank of England where he worked within the Financial Policy Committee (FPC) Secretariat. During this role, George supported the FPC in identifying and analysing major financial stability challenges within the U.K. banking system.

George has a BSc in Economics from the University of Bath with First Class Honours.

Arjun Bawa

Partner | Singapore

arjun.bawa@fairviewcapitalgroup.com

Arjun has over 20 years of private equity and financial services experience and has worked in Asia, US and Europe.

He has significant experience within the private equity Fund-of-Funds industry and co-led the investment activities of PineBridge Investments in Asia, focusing on primary and secondary fund investments.

Prior to that he was responsible for PineBridge Investments’ (and AIG Investments’) fund investment activities in North America and was based in New York.

Arjun sat on the internal investment committees of all primary fund investment portfolios in Asia, US, Europe, Latin America and Africa. In this role and during his tenure at AIG/PineBridge he was involved in over 100 fund investments and joined the advisory boards of over a dozen private equity funds.

Prior to AIG, Arjun worked for Allianz Group in New York and Munich where he focussed on fund investing and direct venture capital investing. He also spent several years with Deutsche Bank in Singapore across various roles including mergers and acquisitions and venture capital.

He holds an MBA from Institute of Management Technology in India and an Honors Bachelors of Commerce from Delhi University in India.

Christopher Lui

Partner | New York

christopher.lui@fairviewcapitalgroup.com

Chris has over 20 years of diverse private equity experience in global emerging markets, including investor related matters, valuations, investments, product development, and fundraising. He has been involved in transactions in Central and Eastern Europe, Latin America, Turkey, Africa, Russia, and the former Soviet Union.

Most recently, Chris was responsible for coordinating ForeVest Capital Partners’ private equity operations and administration functions, including investor reporting, valuations, audits, track record maintenance, and fundraising.

At ForeVest, as a private equity fund manager, Chris participated in a successful GP-led restructuring of an emerging market fund. He was responsible for coordinating the RFP and due diligence process in the capacity of the general partner of the fund and preparing transaction information, analyses, and other materials to the limited partners.

Prior to ForeVest, Chris was a vice president at PineBridge Investments, where he was involved in a realignment of manager incentives and interests with investors, a limited partner-led GP removal effort, and a restart process of a global emerging markets private equity fund. In each of these matters, Chris played a key role in supporting the solutions process and working through various GP/LP issues and concerns.

Previously, Chris was in the Finance and Administration group at The Blackstone Group.

He holds a BA in Economics from New York University.

Sebastian Amui

Partner | Mexico City

sebastian.amui@fairviewcapitalgroup.com

Sebastian has 30 years of experience in private equity generating an average return of 2.4x MoICto investors.

He brings a successful transactional and turnaround experience, with focus in emerging markets, and understanding of the key drivers of several industries, as telecom, energy, retail, healthcare, education, and agribusiness.

Sebastian has served on the Board of Directors of 21 companies with aggregate revenues in excess of $6 billion.

Before joining Fairview, Sebastian spent 8 years as Principal Equity Specialist at the International Finance Corporation (IFC), World Bank Group, investing in equity and mezzanine transactions. Prior to IFC, Sebastian has been a Managing Director with PineBridge Investments and with AIG Capital Partners, for over 12 years.

Before AIG, Sebastian was a Senior Investment Officer at BBVA Banco Frances, in Argentina, where he co-managed a $400 million portfolio that included fixed income, listed equities, and private equity funds in partnership with Merrill Lynch and TCW.

He has been a Professor of Economics and Economic History for nine years at Universidad Catolica Argentina, and holds a master’s degree in Finance from the Universidad Torcuato Di Tella in Buenos Aires, and a BA in Economics from the Universidad Católica Argentina.

Fairview Capital Group Acted as Exclusive Financial Advisor to CDH Investments

We’re proud to have acted as the exclusive financial advisor to CDH Investments on their multi-asset continuation fund.

The transaction was led by the Abu Dhabi Investment Authority.

Freshfields StrongerTogether Latin America regional conference

John Leone participating as a panelist, sharing his experience in cross-border private equity and Latin American transactions.

Practising Law Institute Advanced Issues in Private Funds 2024 conference

John Leone, Managing Partner at Fairview Capital Group, recently served as a panelist on “Liquidity Solutions and Exploring Additional Sources of Capital.”

Fairview Capital Group Advises Declaration Partners on Continuation Fund Transaction

Fairview Capital Group acted as financial advisor to Declaration Partners, a private capital investment firm, in establishing a continuation fund designed to broaden the firm’s investor base in its private equity strategy.

Fairview Capital Group Advises Vaaka Partners on Continuation Vehicle

Fairview Capital Group is pleased to have served as the financial advisor on the strategic continuation vehicle transaction in which Vaaka Partners successfully transitioned its ownership of Tietokeskus from Vaaka Partners Buyout Fund II to a newly formed continuation vehicle majority-owned by Vaaka Partners Buyout Fund IV alongside new co-investor eQ Asset Management; this structure…

Private Capital Podcast Series – How secondaries have become primary to GPs and LPs

Join industry leaders Tim Clark, Global Head of Private Funds and Secondaries at Freshfields, and Pablo Caló, Managing Partner of Fairview Capital, as they discuss the evolution of the secondary market and share insights from their experiences.

AVCJ Private Equity & Venture Forum, Hong Kong – November 2023

Pablo Caló (Managing Partner) served as a panelist on the discussion topic – ‘Secondaries: Asia and beyond.

Fairview Capital Group Advises on Verdane’s Acquisition of HQ Equita Portfolio

Fairview Capital Group acted as exclusive financial advisor on Verdane’s investment in HQ Equita’s portfolio of five B2B technology companies.

SuperReturn Secondaries Europe , London – March 2023

Pablo Caló (Managing Partner) was a moderator on the discussion topic – ‘GP-leds at a discount: back to a buyers market?’

SuperInvestor, Amsterdam – November 2022

Pablo Caló (Managing Partner) was a panelist on the discussion topic – ‘GP-leds: spotlight on continuation vehicles.’

SuperReturn Asia, Singapore – September 2022

Arjun Bawa (Partner) speaking on the discussion topic – ‘In search of liquidity: unpacking the complexities of the secondaries market’.

Fairview Capital Group Advises GED Capital on Vitro Group Exit

Fairview Capital Group acted as exclusive financial advisor to GED Capital in the successful dual-track exit of healthcare company Vitro Group.

AVCJ Private Equity & Venture Forum, Hong Kong – November 2021

Arjun Bawa (Partner) was a speaker regarding “Secondaries: A growing role for Asia”.

SuperInvestor, London – October 2021

Pablo Caló (Managing Partner) speaking on the current market spotlight on GP-led transactions

SuperReturn North America – October 2021

John Leone(Managing Partner) speaking on panel: GP-Led secondaries: The emergence of secondaries as a mainstream private equity investment category.

Investor Relations Marketing & Communications Forum – September 2020

John Leone moderating the panel on GP-led solutions.

Fairview Capital Group Acts as Advisor on Southern Cross $500m Fund Restructuring

Fairview Capital Group acted as financial advisor to Southern Cross on the near-$500 million restructuring of its 2010-vintage fund, advising on the transaction structure and investor process as the firm provided liquidity options and extended the fund’s life amid challenging exit conditions.

SuperReturn, Berlin – February 2020

John Leone (Managing Partner) speaking on structuring GP-led deals.

SuperInvestor, Amsterdam – November 2019

Pablo Caló (Managing Partner) speaking on GP-led conflicts of interest and valuations.

British Venture Capital Association, Limited Partner Summit, London – October 2019

Pablo Caló (Managing Partner) presenting GP-led secondaries in an evolving market to the Limited Partner Summit.